Creating a Tax – Your Quick Setup Guide

- Adding a new tax doesn’t have to be complicated. This section keeps things simple, clear, and ready to go—no second-guessing, no wasted time.

- Whether it’s GST or a custom rate, you can set it up in just a few clicks.

What You Can Do Here

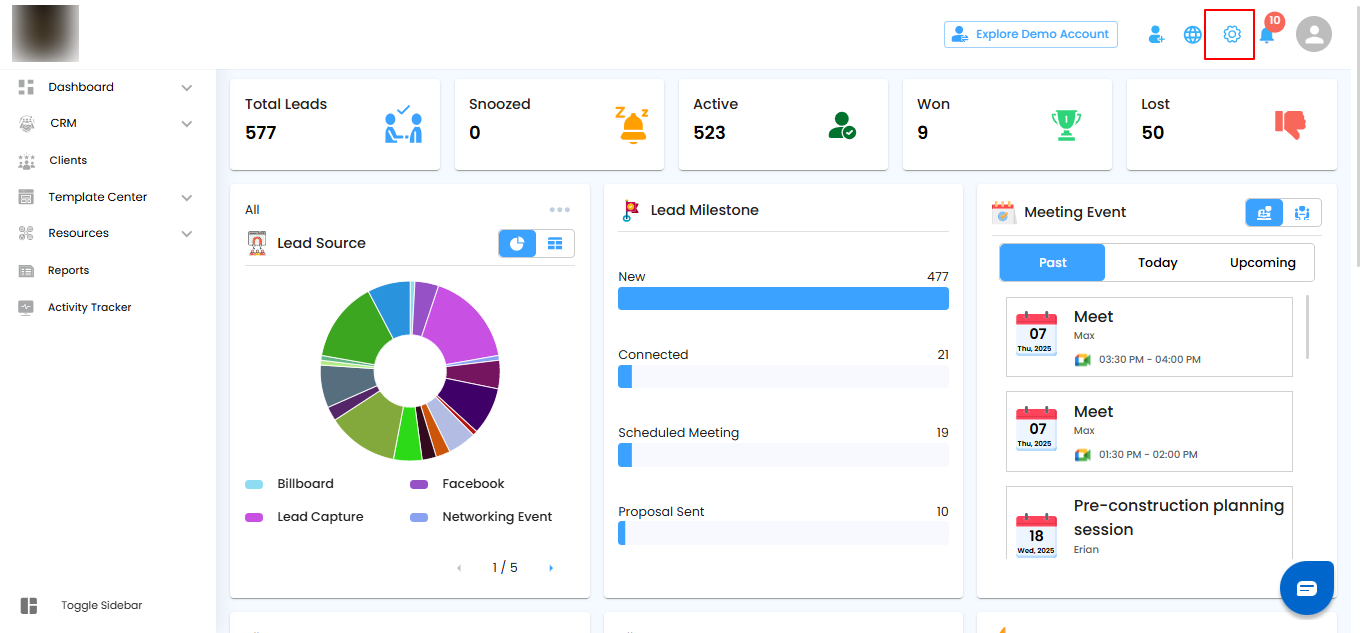

- Click the Settings (gear icon) at the top right.

- Select Localization from the dropdown menu.

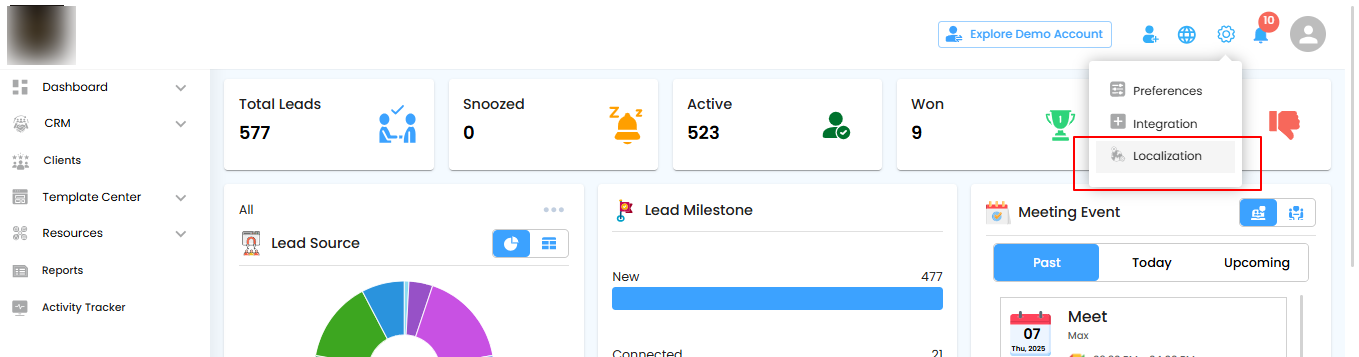

- In the left panel, choose Taxes.

- Click Add Tax to begin.

- Enter the tax name, rate, and other required details, then save

Pro tip: Keep tax names short and clear so they’re easy to identify during invoicing.

Access Taxes – Quick Navigation

The portal keeps tax settings neatly organized for easy access and management.

What You Can Do Here

- In the left panel, select Taxes to view and manage all tax-related settings.

- From here, you can add, edit, or review existing tax entries.

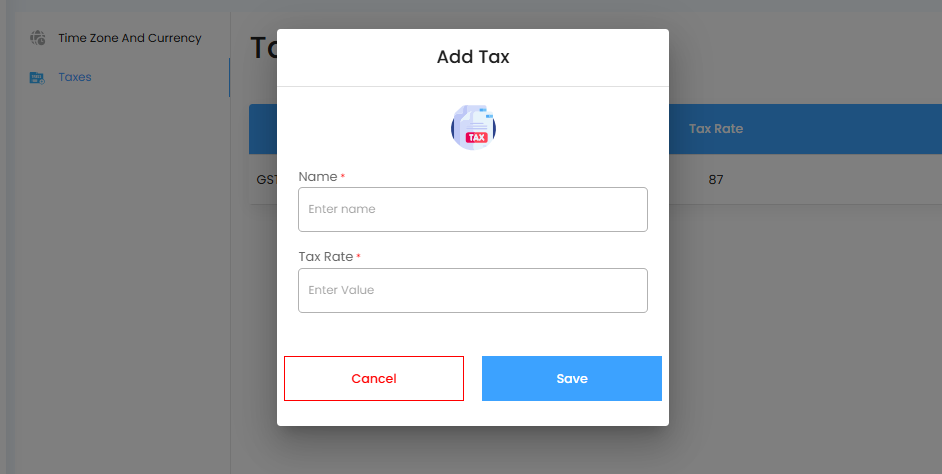

Enter Tax Information – Quick and Accurate

Adding a new tax takes only a moment. Provide the key details and save them securely for future use.

What You Can Do Here

- Fill in the tax name and specify the tax rate.

- Confirm all information is accurate.

- Click Save to store the new tax entry.

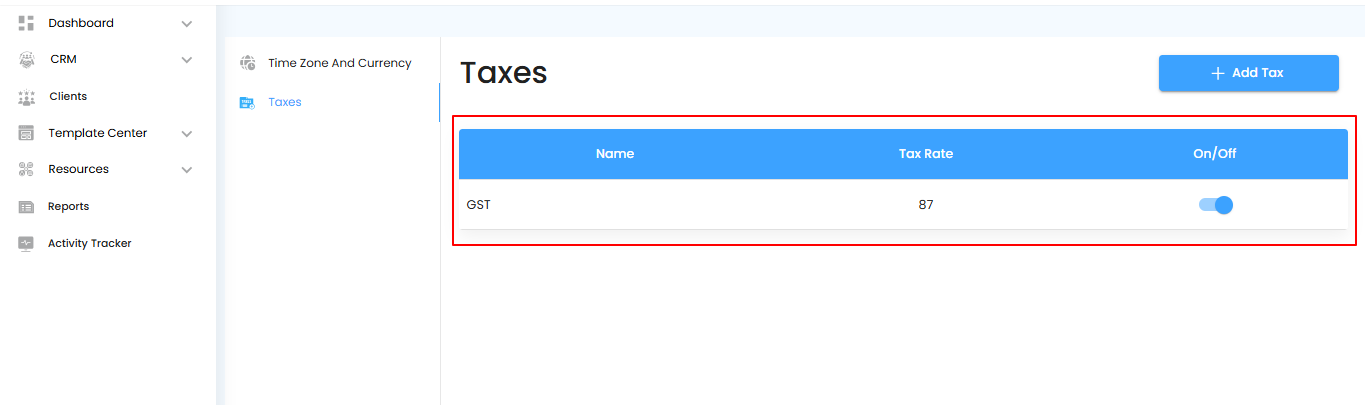

View Newly Added Tax – Instantly Updated

Once saved, your new tax is immediately visible in the portal for easy tracking and management.

What You Can Do Here

- Find the newly added tax listed on the Tax page.

- Review its details to confirm accuracy.

- Use it in transactions and invoicing without delay.

Pro tip: Always verify new entries right after saving—this ensures your setup is correct before applying it.

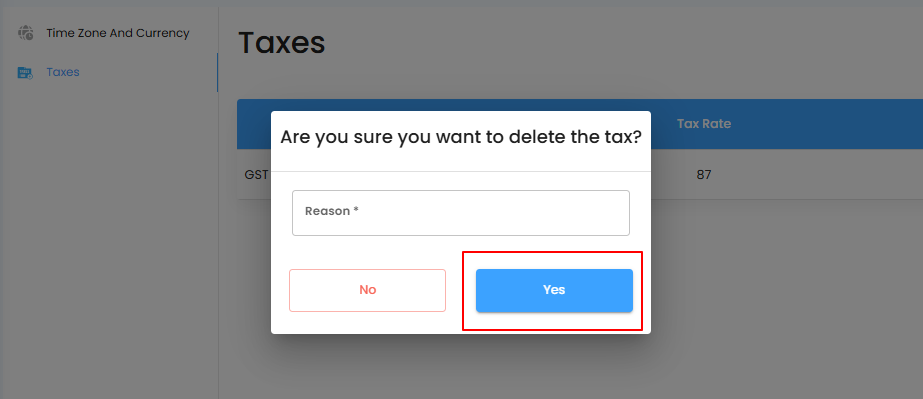

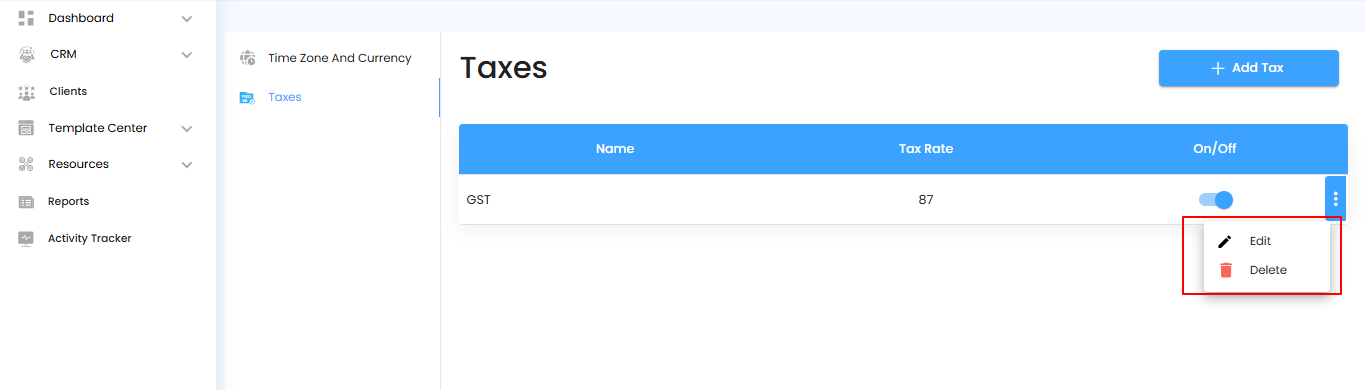

Editing Tax – Update or Remove with Ease

The portal makes it simple to manage your tax settings. Whether you need to update details or remove a tax completely, it only takes a few clicks.

What You Can Do Here

- Modify existing tax details such as name or rate.

- Remove taxes that are no longer needed.

- Keep your tax records accurate and up to date.

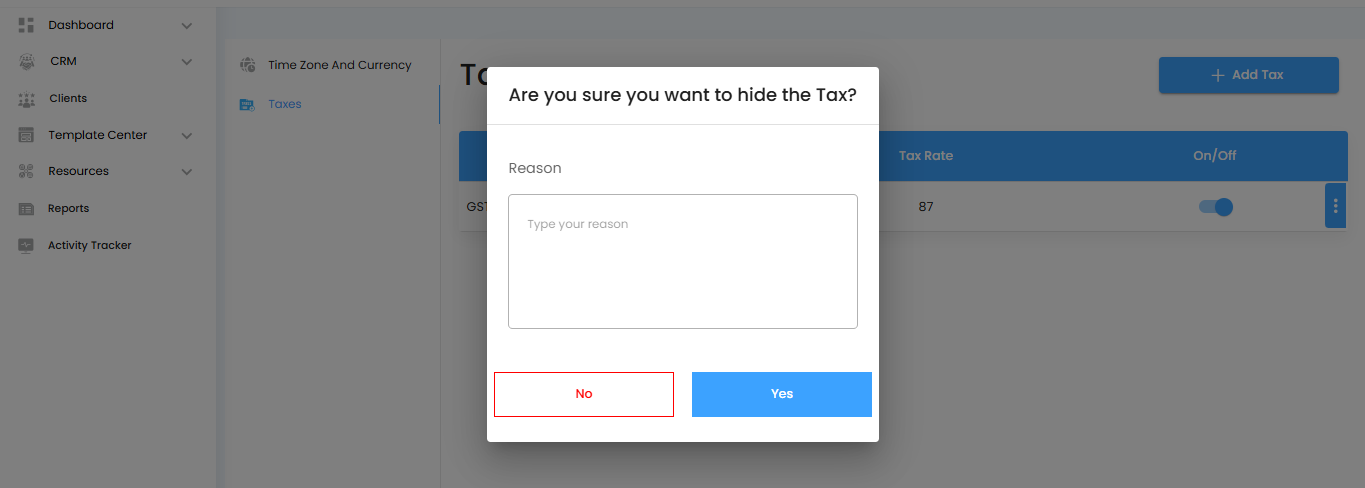

Tax Status Updates – Automatic and Clear

- The portal keeps everything transparent by instantly reflecting your changes in tax status.

- See the tax status update automatically based on your selection.

- Confirm the new status directly on the Tax page.

- Rely on real-time updates for accuracy and control.

Pro tip: Always double-check the updated status to ensure the correct taxes are active or inactive

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article